About Blue Vista

We collaborate, innovate and challenge the status quo to build lasting relationships and create successful real estate investment solutions for our investors.

OPPORTUNITY

Blue Vista offers investors well-conceived, efficiently executed real estate investment strategies to meet their performance objectives. Our professionals utilize rigorous, research-driven processes to identify opportunities and support value creation, with the goal of achieving the best possible results for our investors and operating partners.

RELATIONSHIPS

Blue Vista is focused on serving our investors and operating partners, building long-term relationships, and delivering results. We are a trusted partner for a broad range of investors, including pension funds, insurance companies, endowments and foundations, sovereign wealth funds and family offices.

EXPERIENCE

Blue Vista’s experienced professionals have proven track records, long-term industry relationships and expertise across a wide array of property sectors, investment types, real estate and capital markets, and investment management processes. Since the firm’s inception in 2002, Blue Vista has invested over $13.4 billion in total capitalized value through institutional real estate vehicles focused on U.S. and Canadian real estate strategies.

HISTORY

Blue Vista was founded in 2002 in Chicago as a real estate investment firm with a mission to invest alongside successful investors and sponsors across all property sectors in the U.S. Today, Blue Vista’s platform offers a national footprint in the U.S. and Canada, local operating expertise, and best-in-class investment strategies in exclusively student housing, middle market equity and real estate credit.

Our Values

Meet Blue Vista

We are proud to offer best-in-class real estate investment management strategies. Please watch our video to learn more.

Responsible Investing

Sustainable Investing

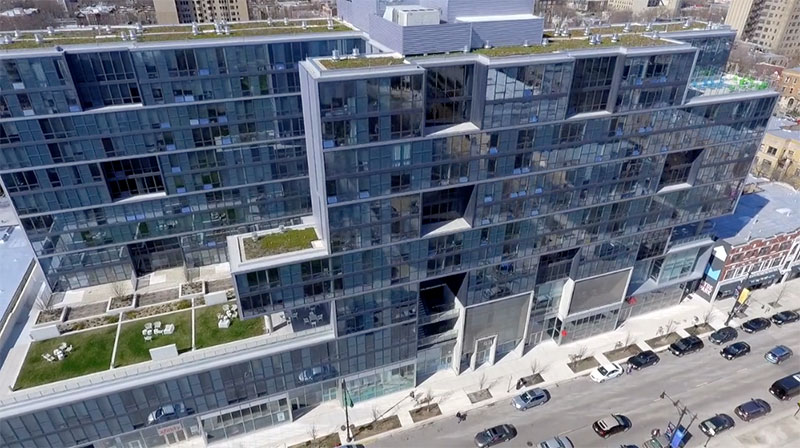

Blue Vista takes the view that utilizing appropriate environmental, social, and governance (ESG) initiatives can optimize the financial and environmental performance of our assets, and bring additional value to our stakeholders. We aim to implement policies that are economically and operationally feasible in relation to our investors’ strategy and return objectives. We see these policies and actions as ever-evolving as responsible investing continues to become more deeply embedded into the real estate industry across various property sectors, markets and strategies.

Risk & Resiliency

Blue Vista has a risk rating tool that takes into account eight major risk categories which guide our investment process, outlined below. Blue Vista’s sustainability/resiliency considerations are embedded into this risk rating tool across each major category, and evaluated during the underwriting process.

1) Market

2) Asset

3) Execution

4) Leverage

5) Return on cost

6) Return characteristics

7) Liquidity

8) Climate risk